What does Labour’s election win mean for your financial plan?

It’s all change at the top. After a landslide win in the UK general election, there’s a new party in charge. So what kind of policies are we likely to see from the new Prime Minister? And what does it mean for your financial plans?

Landslide – but no earthquake

Perhaps the most surprising aspect of Labour’s resounding victory, was the lack of surprise.

There was certainly plenty of election night drama, as the Conservatives (and SNP in Scotland) lost out to a red wave of new MPs. But the final result also had an aura of predictability about it. Labour led in the opinion polls from as far back as December 2022 and never looked back.

As this New Zealand broadcaster’s report summed up the day after the election “the change in power has appeared inevitable for months, if not years.” The big reveal was that she’d actually filmed the clip weeks before and by the time it aired, she’d already flown the 11,000 miles back home.

This predictability, combined with a cautious campaign that was light on anything likely to scare voters, has meant the outcome has only caused mere ripples in financial markets. UK stocks and the pound initially rose slightly the day after.

The next steps

So, after the big win, what now?

“Changing a country is not like flicking a switch”, said Keir Starmer in his first speech as Prime Minister.

Nevertheless, change will come (they wrote it on the side of a bus). And Labour’s promises – which include renationalising passenger rail, setting up a new state-owned energy company and investing more in public services – will need revenue from somewhere. How much of that is going to come from us, the taxpayer?

Throughout the campaign, the accusation thrown at Labour was that they would be putting up taxes. We know some areas already. Plans for VAT for independent schools could mean higher school fees, while Labour also plans to close all loopholes around non-dom status.

Elsewhere, there’s been speculation the new government could raise Capital Gains Tax (CGT), while income tax thresholds are likely to be frozen until April 2028 – which would be likely to see more taxpayers move up a tax bracket as wages increase. Our Private Client tax colleagues have touched on some of the changes we already know about in their latest article which can be read here.

There are other areas that we can probably discount as ‘noise’ – the kind of claims that hit the headlines and are in people’s minds, but don’t go anywhere. Inheritance tax, for example; this hasn’t increased since 2009, but is always likely to come into the conversation when discussing potential changes. Labour had also previously mooted undoing the previous government’s decision to scrap the Lifetime Allowance, but later ruled this change out.

The good news though: we have time until any of these substantial changes are announced. The new chancellor Rachel Reeves has already ruled out holding a budget that doesn’t include forecasts from the Office of Budget Responsibility. These take 10 weeks to commission – so Labour will have to wait until the autumn to set out major spending plans.

Adapting to change

We’ll be keeping a close eye on what the new government says and does over the next weeks and months – and will update you when there’s anything that will affect you and your finances.

But the truth is, whatever changes Labour has in mind, the key is flexibility. A good financial plan is never truly set. The important thing is that it can be optimised, in line with the ebb and flow of government regulation.

In the last 10 years, we’ve had significant areas of reform to contend with on behalf of our clients. Among the most notable was the George Osborne’s pension freedoms, introduced in 2015, which provided more freedom and choice over how you access your pension pots. However, these choices didn’t come without risk. We’ve since helped clients to optimise this freedom and avoid excessive taxes on any income received.

More recently, the tax-free allowance for CGT has been cut dramatically – from £12,300 two years ago to just £3,000 in the last budget. Meanwhile, the dividend allowance has also been sliced.

What happens if these are reduced further? If you’ve got £100,000 in the bank and another £150,000 in something like an investment fund, it won’t take a lot for that money to be hit with dividend taxes or CGT. It makes using tax wrappers such as ISAs even more important.

Working with a financial planner can really help minimise any impact. A planner will always be working proactively behind the scenes, joining the dots to give you maximum optimisation.

Cutting out the noise

As we’ve said previously, we’re careful to advise our clients not to panic during election time. It’s important to filter out the noise. So take all the headlines and rumours over what taxes the new government may or may not be putting up with a pinch of salt for now.

It does appear that the next few months could see a relatively stable backdrop politically. Plus, there’s the potential for falling inflation and possible interest rate cuts, which are positive for the economy – and the pound in your pocket.

Of course, no one knows what lies ahead for sure. So even if it’s not plain sailing, we’re there to support you – through accumulation as you gather wealth during your career – and decumulation as you move into retirement.

Labour’s big slogan for the election was ‘change’. No matter what changes are introduced, we’ll make sure you’re ready.

The LTA is no more: what does that mean for your pension death benefits?

The UK government has scrapped the lifetime limit on what you can pay into your pension. But what happens next? If you’re leaving your pension to someone after you die, here are some important questions we’ve been helping clients answer.

No limits?

The pensions lifetime allowance (LTA) was abolished in April this year, removing the limit on the total amount people can pay in during their lifetime.

This is good news for anyone who’d previously reached their limit because it means they can start to make pension contributions again. This is not only good for your pension pot, but it can also help to reduce your tax liabilities and potentially enhance a tax-efficient legacy for your beneficiaries.

However, the end of the LTA doesn’t eliminate the need for careful planning. With the introduction of new pension rules, it’s crucial to understand the changes and ensure your pension arrangements are structured correctly to maximise their value for you and your loved ones.

The LTA is dead, long live the LSDBA

Here we’re focusing on pension death benefits, specifically the Lump Sum and Death Benefit Allowance (LSDBA). The LSDBA is an important as it has the potential to cause people to make mistakes that could cost their heirs significant sums in income tax and inheritance tax.

So, what’s changed? The LSDBA is the maximum amount that can be left to your beneficiaries tax-free if you pass away before the age of 75. This amount is set at £1,073,000, which is the same level as the previous Lifetime Allowance (LTA). It will be reduced by any Lump Sum Allowance (LSA) formerly known as ‘tax-free lump sums,’ utilised during your lifetime.

It’s something we’ve been speaking to clients about a lot. If you’re wondering if this affects you, these are the points worth considering:

Which taxes do we need to consider?

By correctly structuring your pension arrangements you can provide your beneficiaries with the potential to significantly reduce their income tax liabilities as well as retaining the valuable pension wrapper which is exempt form inheritance tax.

Does it make a difference what age you die?

Yes. If you die before age 75, any beneficiaries will receive payments free of income tax – irrespective of whether it’s a lump sum, or drawdown pension. This is the case whether the money is crystallised (the parts of your pension you’ve already accessed via drawdown or buying an annuity) or uncrystallised (pension savings you haven’t accessed yet).

If you’re over 75 when you die, your beneficiaries would be liable to income tax at their marginal rate on any lump sums they receive.

Does your pension provider offer drawdown?

Many modern pension schemes offer flexible retirement income – or pension drawdown – as it allows you to withdraw from your scheme, while allowing your pension fund to keep growing. It also enables you to keep the value of your pension scheme outside your estate – which is key when it comes to inheritance tax. If your pension funds are in drawdown when you pass away your beneficiaries won’t have to pay income tax on it.

However, many older schemes that were set up before the government introduced ‘pension freedoms’ in 2015 don’t have the ability to offer drawdown. This limits the options for your beneficiaries on death.

Below is an example, where the beneficiary of a £500,000 pension fund that doesn’t allow nominee drawdown, could be liable for over £218,000 in income tax if the holder died after reaching age 75. On the other hand, if the fund did allow drawdown, the beneficiary could avoid paying any income tax at all.

(Please note that we’re using English tax rates in our examples – income tax liabilities will be different in Scotland.)

Mr Smith has a personal pension of £500,000. He has taken no pension benefits previously. Mrs Smith is named as the 100% nominated beneficiary.

Their estate is already valued in excess of the transferable nil rate band and main residence nil rate band for inheritance tax purposes.

Mrs Smith has existing income of £20,000 per annum and does not require any additional income or capital at this time.

| Scenario 1: pension fund DOESN’T allow nominee drawdown | |||

| If Mr Smith dies before age 75…

|

… Mrs Smith receives a tax-free lump sum payment of £500,000 | LSDBA

Income Tax due Estate value increase 2nd death IHT Liability |

£500,000

£0 £500,000 £200,000

|

| If Mr Smith dies after age 75…

|

… Mrs Smith receives a taxable lump sum payment of £500,000 | LSDBA

Additional Income Tax due Estate value increase 2nd death IHT Liability |

N/A

£218,719 £281,281 £112,512

|

| Scenario 2: pension fund DOES allow nominee drawdown | |||

| If Mr Smith dies before 75… | … Mrs Smith can request the whole fund be designated to nominee drawdown, complete a new expression of wish form. | LSDBA

Designate to drawdown Income Tax due |

£500,000

£500,000 £0 |

| If Mr Smith dies after age 75 | …Mrs Smith can request the whole fund be designated to nominee drawdown and complete a new expression of wish form. | LSDBA

Designate to drawdown Income Tax due |

N/A

£500,000 £0 |

Have you nominated who will receive your pension?

If your plan doesn’t offer drawdown, the only option for your family might be to receive a lump sum as already explained. However it’s also important to make sure you have the nomination forms completed correctly to ensure your pension wealth is passed down to the next generation as efficiently as possible.

Nominee drawdown can only be made available to those whom you have nominated as beneficiaries of your plan. Without this the benefits will automatically be paid as a lump sum. Not only could this lead to the beneficiary being liable to income tax on the lump sum payment, it also takes the fund out of the inheritance tax friendly pension wrapper. We can help you fill out and consider expression of wish or nomination forms.

In the example we look at below we can see how by having a plan that offer nominee drawdown with a correctly completed expression of wish form could save over £675,000 of income tax and save the estate nearly £430,000 of inheritance tax.

Mr Jones has a personal pension of £1.5 million and has taken no benefits previously. Mrs Jones is the 100% nominated beneficiary. She also has income of £50,000 per annum.

Their estate is already valued in excess of the transferable nil rate band and main residence nil rate band for inheritance tax purposes.

Mrs Jones does not require any additional income or capital at this time.

| Scenario 1: pension fund DOESN’T allow nominee drawdown | |||

| If Mr Jones dies before age 75… | … Mrs Jones receives a lump sum payment | LSDBA

Excess Income Tax due Estate value increase 2nd death IHT Liability |

£1,073,100

£426,900 £193,323.80 £1,306,676 £429,240 |

| If Mr Jones dies after age 75… | … Mrs Jones receives a lump sum payment

|

LSDBA

Income Tax due Estate value increase 2nd Death IHT Liability |

N/A

£676,219 £823,781 £329,512 |

| Scenario 2: pension fund DOES allow nominee drawdown | |||

| If Mr Jones dies before age 75… | …Mrs Jones can request the whole fund be designated to nominee drawdown and complete a new expression of wish form. | Designate to drawdown

Income Tax due Estate value increase 2nd Death IHT Liability |

£1,500,000

£0 £0 £0 |

| If Mr Jones dies after age 75… | … Mrs Jones can request the whole fund be designated to nominee drawdown and complete a new expression of wish form. | LSDBA

Designate to drawdown Income Tax due Estate value increase 2nd Death IHT Liability |

N/A

£1,500,000 £0 £0 £0 |

Does your pension have protection?

Enhanced protection was brought in when the LTA was first introduced in 2006, offering full protection against tax charges (as long as other contributions or other benefits had ceased). In many cases this protection will still apply.

For example, someone with a personal pension of £10 million with enhanced protection in place would still see some or all this protected when passing this wealth on. If you have enhanced or fixed protection (which maintained the LTA at a fixed level, depending on when it was put in place), you should check the scheme to ensure it’s still suitable for your needs to make sure you can take advantage of the new legislation.

Below we look at an example of a client with a significant pension fund who hold Enhanced Protection.

Mrs Brown has a personal pension of £10 million, with no benefits taken previously. She has Enhanced Protection in place and the fund value of 5 April 2024 was £9 million. Mr Brown is the nominated beneficiary and has other income of £125,000 per annum.

Their estate is already valued in excess of the transferable nil rate band and main residence nil rate band for inheritance tax purposes.

Mr Brown does not require any additional income or capital at this time.

| Scenario 1: pension fund DOESN’T allow nominee drawdown | |||

| If Mrs Brown dies before age 75… | …Mr Brown receives a lump sum payment of £10,000,000. | LSDBA

Excess Income Tax due Estate value increase 2nd death IHT Liability |

£9,000,000

£1,000,000 £450,000 £9,550,000 £3,820,000 |

| If Mrs Brown dies after age 75… | …Mr Brown receives a lump sum payment of £10,000,000.

|

LSDBA

Income Tax due Estate value increase 2nd Death IHT Liability |

N/A

£4,500,114 £5,499,886 £2,199,954 |

| Scenario 2: pension fund DOES allow nominee drawdown | |||

| If Mrs Brown dies before age 75… | …Mr Brown can request the whole fund be designated to nominee drawdown and complete a new expression of wish form. | LSDBA

Designate to drawdown Income Tax due Estate value increase 2nd Death IHT Liability |

N/A

£10,000,000 £0 £0 £0 |

| If Mrs Brown dies after age 75… | …Mr Brown can request the whole fund be designated to nominee drawdown and complete a new expression of wish form. | LSDBA

Designate to drawdown Income Tax due Estate value increase 2nd Death IHT Liability |

N/A

£10,000,000 £0 £0 £0 |

What to do next

When did you last check on your pension? If it hasn’t been reviewed in the last 12 months, then these issues we’ve discussed here are definitely points worth considering. Our advisers are already working with clients helping them make sense of what these changes mean for them and supporting them in making their affairs as efficient as possible.

Want to know more? Get in touch today.

Spring clean your financial planning

With the new financial year in full swing, now is the opportune moment to pause and reassess your personal finances. It’s one of those tasks you’ve probably been putting off, especially amidst the surge in the cost of living; it can be a daunting chore but is absolutely crucial.

Life changes, so it’s vital to consider whether the financial plans you made even just a couple of years ago, are still relevant. Spring is the season to revisit your goals and think about your long-term objectives, so comb through your bank statements, pinpoint where your money is going, and identify where savings can be made.

If you find yourself with surplus income, it’s beneficial to consider how much could go towards your savings goals each month, and where the savings should be deposited.

What’s new for the 2024/2025 financial year?

From the 6th of April, ISA allowances reset at £20k. But the annual allowance for pensions has remained at £60,000.

I’d encourage anyone to commit to saving a set amount each month and before you know it, it will become a habit which will set you on track to making the most of your ISA allowance.

Of course, new pension and tax allowances have been in place since April. While the personal tax allowance didn’t increase in the Spring Budget, the income limit for married couple’s allowance has increased from £34,600 to £37,000.

In addition to these changes, lifetime allowance has been abolished – this is one of the key thresholds governing how much you can pay into your pension, previously this was subject to a lifetime allowance charge. Now that it is no longer in existence, you can benefit from saving as much as you want into a pension without incurring a tax charge.

Planning for the future

For high earners in particular, planning early into the financial year is optimal, taking into consideration any career moves, salary changes or bonuses.

It’s a common theme that those on higher incomes budget and plan for their monthly outgoings but don’t always plan for the future, and as tempting as it is to spend every penny of your disposable income, I always advise clients to get into a good habit of saving as much as they can each month to make the most of tax allowances.

The same goes for bonuses. When you know that lump sum is on the way, think about setting aside an emergency fund for those unexpected expenses and then consider whether you can allocate some to your ISA or pension pot. I recommend aiming for an emergency fund which equates to around three to six months of your annual salary which can be used when needed and rebuilt again.

Retirement planning

In terms of pensions, there are many considerations to be made. For workplace pensions, are you maximising benefits from your employer’s contributions? How much of your expenses will your state pension cover?

The earlier you make plans for your retirement, the better. If you look forward to being able to retire but also want to maintain the same lifestyle as you do now, it’s essential to visit a financial planner ahead of your ideal retirement date.

Helping clients to visualise their financial future with our Lifetime Cash Flow Modelling is a key part of our financial planning offering. It can help to answer questions such as whether you will be able to retire earlier or at least reduce work commitments, and whether you can maintain your desired lifestyle in retirement.

AAB Wealth expands presence in Central Scotland with acquisition of Synergy Financial Planning

Award-winning chartered financial planning firm, AAB Wealth, has today announced the acquisition of Synergy Financial Planning, based in Bishopbriggs, Central Scotland.

Having experienced year-on-year growth since the firm was established in 2011, following this latest acquisition, AAB Wealth will have assets under advice (AUA) in excess of £800 million. The combined team of 37 are spread across Scotland, England and Northern Ireland, each of whom is dedicated to helping families and individuals plan for their future.

The Synergy Financial Planning business led by David Neely, supports over 200 families across Central Scotland and shares the same evidence-based approach to investing as AAB Wealth.

Andrew Dines, Head of AAB Wealth, commented: “Synergy Financial Planning is a fantastic addition to our expanding team. David has been instrumental driving the growth of the business and his approach to financial planning and client support match perfectly with our philosophy. I look forward to welcoming David and his team to AAB Wealth to continue delivering the very best financial planning advice for our clients.”

David Neely, owner and Financial Planner at Synergy Financial Planning added: “This is a truly exciting next chapter for our team and clients. Synergy and AAB Wealth have the same ethos. Developing long-lasting relationships which deliver the best outcomes in helping our clients to get the most out of life lies at the heart of what we do. The transition for Synergy Financial Planning clients will be seamless, as both of our firms utilise the same platforms and systems to support clients to achieve their financial goals.”

The team from Synergy Financial Planning will join AAB Wealth with immediate effect and will remain based in their office in Bishopbriggs.

This marks the second acquisition for AAB Wealth following the announcement of Kilkee Financial Planning in January 2023. AAB Wealth was awarded the PFS Financial Planning Firm of the Year accolade for 2023, and has recently been announced as a VouchedFor top-rated firm for 2024.

Featured image left to right: David Neely and Andrew Dines.

If you own a family business don’t forget these 5 important rules

Family businesses are the lifeblood of the UK economy. Working alongside your partner or children can be rewarding and even bring tax advantages. But running one is a delicate balancing act, with emotional ties that sometimes prove complex to unravel.

Around 90% of the UK’s private companies are family run. Alongside the usual business concerns, such as cashflow and making sure it’s well managed, there are other specific challenges. Not least, knowing that those tricky conversations you have during the working day are likely to spill over to the family dining table.

We’re able to advise our clients on several aspects of running a family business, not just financial, so let’s take a look at five key areas:

1. Be clear on your endgame

Starting at the end might sound counterintuitive, but family succession has a reputation for conflict (think Game of Thrones or, indeed, Succession). That’s why it’s so important to be clear from the very beginning about what you want to do.

How and when do you plan to retire? Do you want to pass the business on, or are you selling up instead? Are you preparing someone in your family to take over?

A new client came to us recently with questions about what might happen when he takes the reins. His parents, now in their 70s, are reducing their involvement, but their company was serving two purposes: a going concern to leave to the family, and the main pillar of their pension pot.

Their son was concerned that, on the current trajectory, there wouldn’t be much wealth left in the business by the time they fully retired. With the aid of some cashflow modelling, we’ve now put both the son, his parents – and the business – on a better footing.

Examples like this show it’s important to be clear on your endgame from the start and have transparent conversations along the way. That way, everybody is working towards the same goal.

3. Take care of your basic needs

With this endgame in mind, you then need to make sure you’ve got the basics right.

Do you have the money to run things day-to-day?

Cashflow modelling tools, such as those we use, can provide valuable insights into your cash position and help you make informed decisions that ensure you have enough liquidity to sustain operations and pursue growth opportunities.

Can you get money out of the business if you need it?

This is often a big concern for our clients. A lot of this depends on how your business is set up – for example, are you listed with HMRC as a sole trader, partnership, or a limited company? There are pros and cons to all three. It’s important to remember a family company isn’t a private bank account (you’re usually limited to either taking a salary, dividend payments from profits, a director’s loan, or business-related expenses).

Do you have the right people in place?

Of course, this applies to all businesses, but it’s a pertinent question when approaching it in a family context. Maintaining that balance between family involvement and making sure the business is well-run can mean difficult conversations. It requires owners who are clear-sighted about their limitations and where they might need to bring in outside help.

3. Get your taxes in order

Tax is one of the most important areas we talk to our clients about. Many family business owners worry they’re paying too much. And there are several ways running a family business can help you reduce your liabilities. For example:

Dividends: If you’re a limited company, making your spouse or partner a shareholder means they’re entitled to dividends (as long as the company is in profit). These are taxed at a lower rate than income tax: 8.75% (basic rate), 33.75% (higher rate), and 39.35% (additional rate). There’s also a tax-free dividend allowance, but this was cut to £500 for this current and future tax years.

Salaries: Paying a partner a salary instead is also tax deductible as a business expense, which will reduce your Corporation Tax. Be warned though, it must be a legitimate business function.

Paying a salary can also reduce your national insurance (NI) liabilities. (Sole traders can also go down this route, to reduce their income tax liability.)

4. Have a succession plan – or an exit strategy

We’ve already mentioned the importance of knowing your endgame. This is especially relevant when it comes to tax. Passing on your family business can trigger Inheritance Tax (IHT) or capital gains tax (CGT). Tax-relief options are a regular topic of discussion with our clients. Having the right succession plan, or exit strategy if you’re considering selling up, means you can pass down wealth more efficiently to future generations at the right time.

Hold-over relief: By gifting shares in your business to your child, or selling them for less than they’re worth, you can potentially avoid any CGT due (they will have to pay this if they dispose of the asset).

Business relief: You can reduce IHT on your estate by either 50% or 100% with business relief, providing you’ve owned the business assets for at least two years. Business relief can be passed on while you’re still alive or as part of your will.

Trusts: If you’re planning to sell, transferring shares in the company into a trust in the pre-sale process (that is, before the agreement to sell is confirmed) can help mitigate IHT. Trading businesses are usually exempt from IHT as they qualify for 100% business relief. By contrast, if transferred after the sale, the £325,000 IHT limit would apply. Anything above that would be liable for a charge.

5. Embrace change

Finally, if you’re considering passing the baton at some point, it’s important to acknowledge that change is inevitable. New challenges and disruptors will emerge, and the next generation will have their own ideas on how to approach this.

The successful family businesses are those that embrace change, invest in new technology, explore new growth avenues, and are unafraid to consider new approaches when they need to.

Again, as with so much about running a successful family business, communication is the key. Involving people in decision making, keeping them abreast of what’s happening in the business, and discussing the vision, means your family business can go from strength to strength.

Running a family business and want to know more about how you can plan for the future? Get in touch with us today.

Asking these 5 big questions? You need a financial planner

Seeking advice isn’t just for the super-rich. And it’s not just selling you investment products. If you’ve never talked to a financial planner, you may be unaware of what we do and the important questions we can help you answer.

Whenever we meet a potential new client for the first time, it’s only natural that there are a lot of questions.

Some are technical – for example, questions about our fees or processes. Usually though, it’s these five that tend to stand out:

- “When can I afford to retire?”

- “How do I make sure I don’t run out of money?”

- “What can I afford to spend now?”

- “Is my money safe if the market crashes?”

- “What happens to my family if I’m ill or lose my job?”

That last question is perhaps the most pertinent.

It’s a reminder that financial planning is about more than just numbers. If you get ill or lose your job, you want to know you’ll still be financially secure. If you die unexpectedly, you want reassurance your loved ones will be ok.

Why you need a financial planner

Around half of UK adults are invested. That is, they’ve put their money in something other than a savings account or a cash ISA.[1] In the UK, there was around £8.8 trillion assets under management (AUM) as of the end of 2022.[2]

And yet, according to research from last year, more than half of UK adults have never had a financial adviser. More than a fifth said they never will.[3] But in that same report, one in 10 consumers admitted they regretted not having previously sought out advice. Some said they now worried they wouldn’t have enough to fund retirement, others believed they’d underestimated the impact of inflation, lost money, or bought the wrong product or service as a result.

Having money set aside is one thing. Knowing if it will help you answer your big questions is quite another.

This is where financial planners come in.

More than just managing your money

A financial planner goes beyond financial advice. We don’t just focus on managing your money and investments. Instead, we work with you to set your goals, then, over the course of our meetings with you, we help you put a plan in place to help achieve them.

To do that, we need to focus on you – the human behind the numbers – and ask some questions of our own.

- What are your short and long-term goals?

- Who are you financially responsible for?

- If you’re thinking about retirement, what does the ideal look like?

- If you’re selling a business, what are your top priorities?

- What are you passionate about – and what would you like to do more of in the future?

From here, we’re able to walk you through our detailed cashflow models that set out the different options for the future, as well as being able to speak with specialists from across the wider AAB group. This makes what you’re saving towards clear and tangible.

Take our client Crawford. After suffering a heart attack, he decided to take early retirement.

Our initial meetings with him and his wife were all about asking those big questions. Could he afford to retire early? Where was the best place for his pension? Most importantly, what was the best route that allowed him to retire stress free and confident that he and his family are well looked after?

Or Tara, who came to us looking to find out how she could optimise her investments as she planned for the future. As a higher earner, she had questions on how the taxes she pays could impact a future retirement date. Based on our conversations and the questions asked on both sides, we were able to show her a detailed graph of her outgoings that allowed her to envision what their future could look like – and from there we could work out her ideal retirement age.

Now, with a financial planner and the added benefit of a specialist AAB tax adviser. Tara says she feels “much calmer” about her family’s financial future because she knows there’s someone keeping an eye on things.

“What if…”

Let’s look back to those five big questions. Whatever the reasons you first come to us, whether it’s about wanting to transfer your pension, selling your business, or managing a sudden windfall, it’s likely that one or all of these questions will be on your mind.

The answer to them all starts with the financial plan.

As we build up a trusted relationship with you, we help you put together a comprehensive, personal plan that encompasses your financial goals over the short, medium and long term.

So that when you ask “what happens if…” you know what the answer is.

[2] Source Investment Association (IA) Investment Management in the UK 2022-2023. As of end 2022, AUM managed by IA Members

[3] Source: Future of Advice – State of Flux (2023), AKG, Canada Life and Charles Stanley

How Accountants and Financial Planners Team Up for Success

When you work with a financial planner, the last thing you want to hear when asking for tax advice are the words: “That’s outside my area of expertise”.

Some financial planners are in a position to offer some tax advisory services, but sometimes you need an accountant to oversee your financial plan alongside your financial adviser. That way, they can identify ways to improve tax efficiency and help you reach your goals together.

Thankfully, when you work with the AAB Group, you can benefit from financial planning and tax advice all under one roof. One of our clients, Nigel, even described us as a ‘one stop shop’.

When your financial planner and accountant work together, you can expect a more thorough service and better results. You’ll hopefully sleep soundly at night knowing that not only are you getting the most out of your savings, investments, pensions, and protection insurance, but you’ve been given everything you need to achieve your goals from an aligned and responsive team.

If you’re wondering how accountants and financial planners work together in practice, take a look at our client Jack’s story below:

Meet Jack

Jack got in touch with us in 2023 after learning about our approach to financial planning and accounting. He was in the process of selling his business and wanted to find a way to retire comfortably alongside his wife Fiona.

He didn’t want an adviser who’d offer a ‘copy and pasted’ solution based on a glance at his financial situation. What he really needed was a financial planning team willing to explore every aspect of his family’s finances and really shake things up.

Getting to know each other

When Jack arrived at our office to meet us, he was greeted by two members of the team: Tom, Chartered Financial Planner and Steve, Private Client Tax Adviser.

The main purpose of this initial conversation was to get to know Jack. Of course, we wanted to learn about his financial situation and discuss his priorities, but we also wanted to know who he was as a person and what made him tick. When we meet a client for the first time, we try to make it feel like a catch up with an old friend, rather than a serious business meeting or interrogation.

During our conversation, we learned that Jack and Fiona’s main priority was maintaining their lifestyle. They’d worked hard for their money and wanted to enjoy the fruits of their labours, but they also wanted to support their adult children who were experiencing difficulties moving up the property ladder after starting their own families.

Like many doting grandparents, they wanted to set money aside for the grandchildren too and were particularly interested in exploring tax-efficient ways of leaving a legacy.

The first steps

After our meeting, Tom got to work creating a detailed lifetime cashflow forecast based on Jack and Fiona’s income requirements and lifestyle costs.

He considered how their expenses could change over time. They’d need money for travel, hobbies, and other non-essential expenses while relatively young and in good health, but their outgoings would almost certainly taper off in the later years of their retirement.

The next step was to stress test our cashflow model against various possibilities. If, for example, interest rates rose significantly, a member of the family became critically ill, or both Jack and Fiona lived to 100, what impact would this have on their lifestyle?

With all this data to hand, Tom was able to identify the most suitable assets and financial products to meet the couple’s financial needs. He also created a detailed plan explaining exactly how much the couple could afford to give to their loved ones without impacting their financial stability and lifestyle.

The next phase

Of course, the financial plan wouldn’t be complete without Steve’s tax planning expertise. Steve explored ways to make sure the couple didn’t pay more tax than they needed to when it came to gifting money to their children.

The first step here was to make sure that any gifts made to Jack and Fiona’s children wouldn’t incur Capital Gains tax. Capital Gains tax arises when you sell an asset and make a profit or gain from it. We also wanted to ensure that Jack and Fiona didn’t give up control of these assets completely, as they’d said they wanted to retain protection of them.

So we suggested setting up trust. This would mean that the Capital Gains tax could be deferred and Jack and Fiona could protect their assets until they were ready to pass them on. This was also important in terms of helping to minimise any potential future inheritance tax.

We also identified – from the work that Tom had done with them – that their income was higher than their spending requirements, so there was room to make some additional gifts there. As such these gifts can be classed as being outside their estate, which means that they’re not subject to inheritance tax either.

Making our recommendations

We sat down with Jack and presented him with an in-depth report outlining his options. The report explained how he and Fiona could meet their objectives, the potential pitfalls and a specific timeline showing when inheritance tax savings would need to be made.

We also made recommendations regarding Jack’s pension and investments. Pensions can provide an incredibly tax-efficient way of saving for retirement, but when we looked into Jack’s pension arrangements, we found them to be outdated and inefficient. To take full advantage of their tax-efficient benefits, we needed to restructure Jack’s nest egg.

We advised Jack that he could strengthen his portfolio, increase his returns and reduce his tax bill with the help of a globally diversified, evidence-based approach to his investments.

The results

Jack told us he felt he’d been on a ‘transformative journey’ through collaborating with the AAB Group. After initially seeking a partner to navigate the complexities of selling his business and retiring comfortably, he found much more than just financial guidance; he discovered a team that viewed his family’s aspirations, lifestyle goals, and financial security as their priority.

The collaborative efforts of Tom, our Chartered Financial Planner, and Steve, our Private Client Tax Adviser, ensured that every facet of Jack’s financial landscape was meticulously analysed and optimised. This not only included a detailed lifetime cashflow forecast and stress testing against various life scenarios, but also a sophisticated tax planning strategy that maximised Jack’s ability to support his family while minimising their tax liabilities.

Knowing that his and Fiona’s lifestyle can be maintained, their children supported, and a legacy left for their grandchildren, all while ensuring tax efficiency, helped Jack sleep better at night. His story shows the significant difference comprehensive planning can make, setting a new standard for what clients should expect from their financial advisory teams.

Elections don’t have to spell panic for your portfolio

Is a Labour or Conservative government better for my investment portfolio? Will markets crash if Donald Trump gets into the White House? 2024 is a year of big elections, but they might not have the impact that you think.

This year will see a record-breaking number of elections worldwide. Around 2 billion people are voting across 64 countries. Among them, a rematch between Donald Trump and Joe Biden for the US presidency, and in the UK, a Tory party hoping to hold off a serious challenge from Labour, after 14 years in charge.

Investors don’t tend to like big changes or surprises, so election time can be quite a nervy affair. In the last few months, we’ve had a number of questions from clients about how this year could affect them. Will Trump ‘Mark 2’ be good or bad for markets? Will a Labour victory mean higher taxes?

The good news is that with the benefit of prudent long-term financial planning, things needn’t change much for you at all.

How politics impacts your portfolio

There’s no denying the influence politics can have on markets. A change of policy, new regulation, or a tax increase can push share prices up or down.

Sometimes a single event has an instant and dramatic effect (just look at what happened after the Liz Truss mini-budget in 2022). But, when viewed through a more long-term lens, things don’t just fall off a cliff. The big losses are only temporary.

To illustrate this point, let’s look back to 2016 – a year of two serious political shocks. The UK voted to leave the European Union, and Donald Trump defeated Hillary Clinton in the US. Both events went against poll predictions. Initially, both caused a stir in investment markets.

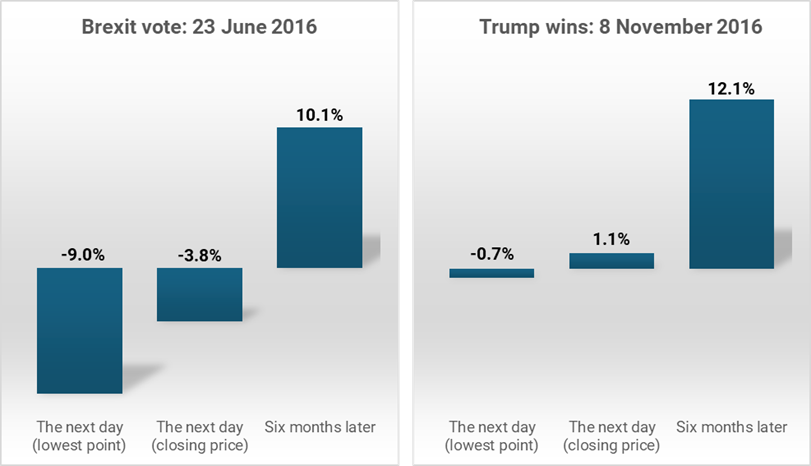

The UK market fell in the immediate aftermath of the Brexit vote on 23 June (as the chart shows, the FTSE All Share was down 9% down the following day at its lowest point). Six months on though and the market had recovered. Global markets also fell in the November when it became clear Trump was likely to win but the slump didn’t last long. In fact, the US market actually ended the day after the election slightly up.

Of course, these are just snapshots, but they illustrate a wider point that markets tend to shrug off elections, even the really surprising ones. Looking long term, the volatility evens itself out. So, when voters go to the polls, there’s no need to panic.

Source: Investing.com, Chart shows performance change between the day before the Brexit vote (23 June 2016) and Trump’s election victory (8 November 2016) and the lowest point in the market the day after, the end of the next day and six months on. UK market data is FTSE All Share (in sterling), US market data is S&P 500 (in US dollars).

Planning not panic

Of course, with wall-to-wall election coverage, dialling down this panic can be difficult. This is where good financial planning becomes so important.

Our role at AAB Wealth is about making sure we get the details right. That means making the most of any tax advantages available at the time (such as ensuring you’ve used your full ISA and pension allowances), ensuring your plan is always aligned to your goals, and checking in with you to ensure the strategy is up-to-date.

These details may seem small at the time, but they make a huge difference. And they mean we’re always prepared for potential surprises.

Additionally, as part of the wider AAB Group, you benefit from expert financial planning and tax advice all under one roof. This comprehensive approach helps us to create a truly in-depth plan that can withstand any short-term shockwaves.

- When you speak to us, our Chartered Financial Planners create a detailed personalised lifetime cashflow forecast. They then stress test it in different scenarios, considering outside influences such as rising interest rates, or the impact of changing personal circumstances.

- At the same time, our tax experts explore in greater detail areas such as reducing your tax liabilities (including inheritance tax and capital gains) to help you get the maximum out of whatever assets or investments you have.

A final thought

Imagine a big rugby match, the final weekend of the Six Nations at Murrayfield. The coach has carefully worked out a game plan to take on the opposition, with carefully judged tactics on how to approach every line out, maul and scrum.

But as game day approaches, the weather forecast changes. Instead of a calm, sunny day, it’s now looking like wind from the east. Does this mean throwing out the whole play book and starting again?

Quite simply, no. It’s just one of 101+ variables that have already been prepped for. A successful coach takes the new information, makes small adjustments where necessary and adapts the game plan. It’s very similar to our approach to planning – no single event will ever undo the strategy we’ve carefully created.

Speak to us about how our services can help you create a plan that withstands short-term shocks and gives you confidence in your portfolio.

AAB Wealth Accredited as one of the Top-Rated Financial Advice Firms for 2024

AAB Wealth, a leading independent chartered financial planning firm, has qualified as one of the top-rated financial advice firms for 2024 by VouchedFor, following outstanding client feedback.

This marks AAB Wealth’s inaugural VouchedFor accreditation since the initiative launched four years ago. The 2024 application process required firms to meet a higher standard of client experience than previous years, rendering the qualification particularly noteworthy.

AAB Wealth is one of 112 firms achieving this status from across the United Kingdom with an overall rating of 4.8 out of 5.

In addition to qualifying as one of top-rated firms, eight of AAB Wealth’s financial planners have been recognised as top-rated financial advisers, demonstrating their commitment to delivering client service excellence.

Aberdeen – Lisa Tait, Ian Campbell, Martyn Paterson

Belfast – Debbie Connolly and Alastair Moore

Glasgow – Alan Turner

Edinburgh – Richard Johnston

Leeds – Tom La Dell

Head of Financial Planning at AAB Wealth, Ian Campbell, expressed a deep sense of accomplishment, stating, “I am incredibly proud of this achievement for AAB Wealth, and I commend the individuals who have deservingly secured their place in the list of top-rated financial advisers in the UK. This achievement is testament to our team’s commitment to providing the best advice to our clients across Scotland, England, and Northern Ireland.”

AAB Wealth will be listed in 2024 Guide to Top Rated Financial Advisers which will be distributed in The Times, The Telegraph and The Mail on Sunday, reaching over 3 million people across the UK.

Three key points from the Chancellor’s Spring Budget

Jeremy Hunt says he wants to keep taxes low and boost investment in British business. So what will his latest plans mean for your finances? We’ve picked out some highlights for you to consider from the latest Spring Budget.

No big surprises, no rabbits produced from hats. But that’s not to say there wasn’t anything of note in the latest Budget that won’t impact your short-term financial planning. We’ve taken a look at the main points below:

1. Cutting National Insurance – will it make a difference?

Having already announced reductions in his autumn statement, Jeremy Hunt announced a further cut in NI contributions. From 6 April, the main rate falls to 8%, while self-employed NI contributions drop to 6%. Looking further to the future, Jeremy Hunt wants to scrap NI contributions altogether, claiming they penalise those who work with double taxation. This cut is funded, in part, by phasing out the ‘non-domiciled’ tax status.

Will this make a difference?

While NI cuts are welcome, income tax bands are still frozen, so many could still end up paying more tax. The total tax take (including income tax, NI, VAT, and other areas such as property sales) is at a post-war high. It’s also worth bearing in mind that, if the ultimate plan is to abolish NI altogether, then it’s likely income tax would go up (a fact the Chancellor has acknowledged following his budget announcement).

2. Buy British– big plans to boost UK equities

There were several measures aimed at reinvigorating investment within the UK. The Chancellor wants to create a ‘new generation of retail investors’, selling off the government’s remaining NatWest shares this summer, and creating a new British Savings Bond, offering savers a guaranteed fixed rate over three years,

The biggest announcement was plans to create a new British ISA, which will focus solely on UK equities. This will offer investors an additional £5,000 on top of their other ISA entitlements (currently £20,000 for adult ISAs and £9,000 for Junior ISAs) with the same tax advantages.

Mr Hunt hopes this will lead to more UK investment into domestic growth stocks (the proportion of UK shares held by UK-resident individuals has fallen to just above 10%)[1]. He also wants defined contribution pension schemes and local authorities to declare how much of their holdings are in UK equities.

Diversification is better

We’ve highlighted before the advantages of seeking a balance of sectors, regions, and avoiding a home bias in investment portfolios, most recently here. Staying disciplined and diversified in stock selection protects your investments when markets are volatile and allows you to make gains when different sectors are doing well.

Therefore, an ISA that’s only focused on UK equities could be risky if that’s an investor’s only exposure to the market. As we highlighted here, being too focused on your home market means missing out on potentially key sectors. Another potential side effect could be that investors simply reallocate existing UK exposure held elsewhere to the new wrapper, meaning the overall investment into UK stocks doesn’t increase.

Consultation on the scope of the new British ISA runs until 6 June, so we will have to wait and see if it sees the light of day.

3. Could property reforms see more sales?

The Chancellor also announced changes that could affect whether some property owners decide to sell.

He’s put an end to stamp duty relief for people buying more than one property in a single transaction (Multiple Dwellings Relief). While intended to support investment into the private rental sector, Mr Hunt said there was ‘no strong evidence’ this had happened and added the system was regularly abused. He’s also abolished special tax rules for furnished holiday lets, which means that income from these will no longer be relevant UK earnings for pension purposes.

The government also cut Capital Gains Tax on some properties, reducing the higher rate from selling a residential property from 28% to 24% (the lower rate stays at 18%). This move is designed to generate more transactions in the property market. It could mean that if you own a second home, it might make more financial sense to sell it. However that 4% difference would have to be offset against other considerations.

What next?

With a general election due by January 2025 (at the very latest), this year’s Budget speech was all about this government showing voters it wants to cut taxes, while others want to put them up. Jeremy Hunt painted a positive picture for the economy: inflation down from 11% to 4% and could go below 2% in the next few months. GDP is growing again, albeit slowly, and debt is predicted to start falling too.

All this is potentially good news. However, despite Mr Hunt’s references in his budget speech to ‘permanent’ cuts in taxation, nothing is written in stone – particularly with a potential election on the horizon. When it comes to looking at your financial plans, it’s important to take note when changes occur – but make sure that short-term changes don’t steal focus from your long-term plans.

Speak to us today about your financial planning.

[1] Office for National Statistics. Ownership of UK quoted shares: 2022